Come back on your desktop!

This page is optimized for desktop viewing, please come back on your computer for the best experience.

This page is optimized for desktop viewing, please come back on your computer for the best experience.

Why do some organizations seem to excel from the jump while others churn through ideas, tech stack products, agency relationships, and their own employees with little to show for the effort?

And why do even the most successful organizations fail to question outdated assumptions about effective strategy—even when there is clear evidence pointing toward other solutions?

At build/create, we are nothing if not curious. When we find a good question, we put in the legwork to find a well-founded answer.

Our process is grounded in research and involves deep listening, client interviews, and competitive analyses. Now, we’re taking our process to another level by gathering insights into the industry as a whole.

We partnered with independent research firm Audience Audit to conduct proprietary attitudinal segmentation research with the goal of learning more about how leaders in the manufacturing technology industry view their marketing.

In our search for the answers to those questions we asked 189 decision-makers at the manager level or above who work for B2B or B2G organizations how they think and feel about topics ranging from optimism about their business, hiring priorities, internal culture, and the ways they measure success.

What we found was a paradigm so compelling, it transformed how we think about B2B marketing.

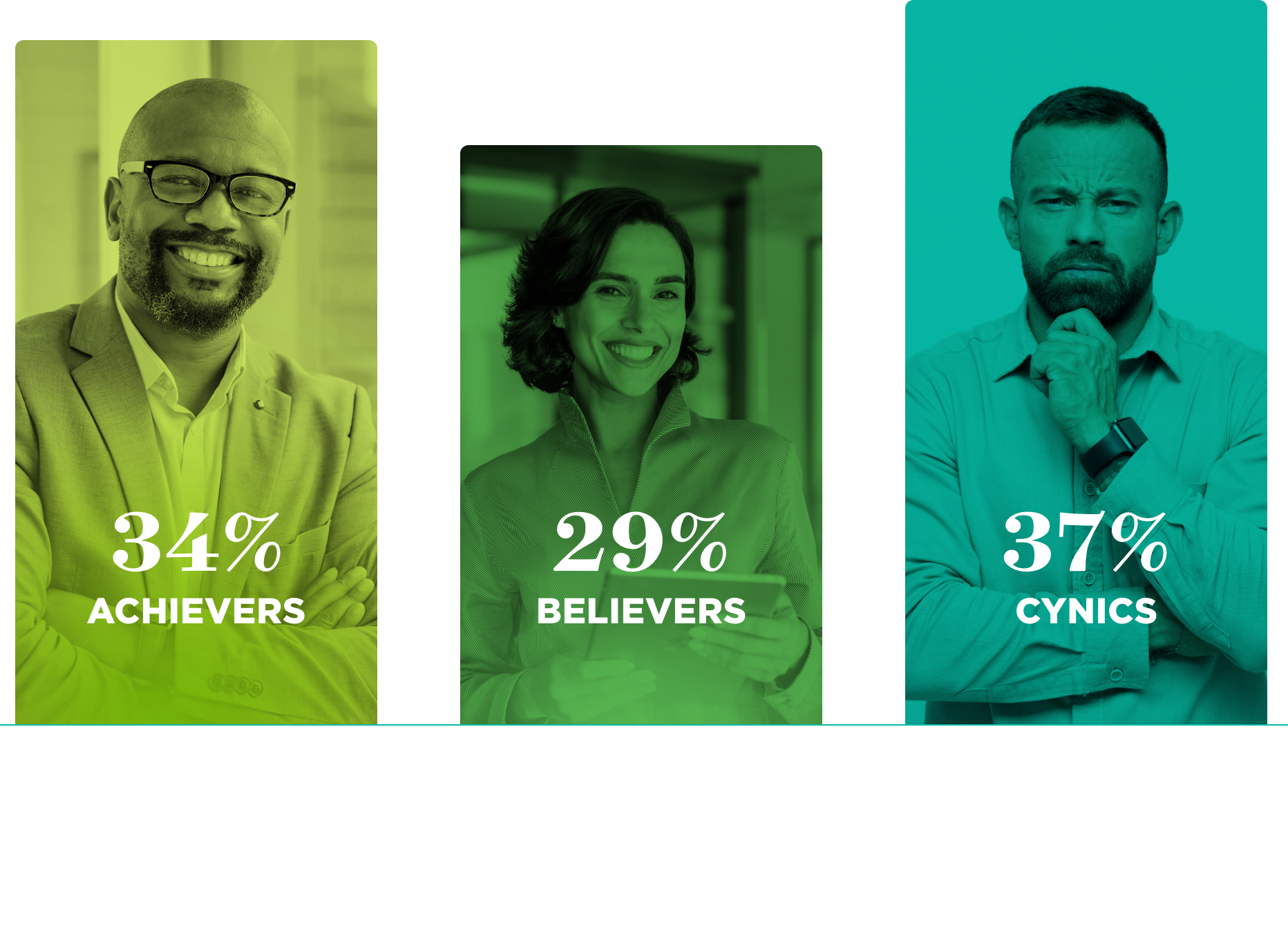

Three unique mindsets that emerged from our survey respondents.

How each mindset thinks and feels about the challenges they face marketing their organization.

Insights into how to think about and approach those same challenges in your own marketing.

Ian (Founder), Eric (Founder), and Laura (Director of Marketing), are joined by Susan Baier, our research partner from Audience Audit to discuss, explore, and unpack the research premise and three deep cuts from the research report.

In this video you’ll find lively discussion around marketing challenges in the B2B sector, how some of us identify with the different mindsets our research uncovered, and a hot-takes on marketing metrics, paid ads, AI, and more.

Our research revealed three unique mindsets among decision-makers. These mindsets differ in their approaches to marketing and their views on everything from staff turnover to conversion rates.

These mindsets were not pre-determined: they were revealed by our research based on correlations that emerged from within the data.

Some businesses have developed a formula for success so dominant, they’ve left their competitive field in the dust.

Others are determined to find their own pathway to success, but struggle without map or compass to guide them. And the final group have lost their way so completely, they doubt there is even a path to search for—let alone follow.

I think it’s safe to say we’d all like to call ourselves Achievers, yet we know that the marketing investment required to generate a return on investment—and the struggle to prove that value—is enough to turn the most devout believer into a jaded cynic.

So how can we know when we’re achieving all that we can?

I’m confident in my organization’s approach to marketing.

My organization is changing the status quo in our industry.

My organization does a good job of showing our prospects how we can help them.

My organization does a good job of managing its tech stack.

Respondents indicated strong agreement that they:

There’s a lot my organization could do to improve how we market our products and services.

My organization needs to differentiate itself.

Customer feedback is essential for improving my organization’s offerings.

My organization’s approach to integrating new technologies needs to be more organized.

Respondents indicated strong agreement that they:

Marketing is a waste of time and money for my organization.

My organization doesn’t need to understand how our prospects think, feel, and behave in order to sell to them.

My industry is too boring to communicate the benefits of our offerings in an engaging way.

My organization’s tech stack just makes everybody’s jobs more complicated.

Respondents indicated strong agreement that they:

Are you a proud Achiever, a determined Believer, or an ambivalent Cynic?

At different points in our careers I’m sure we’ve all identified with all three mindsets, and the goal of this report is to help you steadily move towards being an Achiever in your current role, and achieve more, more consistently!

Our survey covered a range of questions and the data yielded much more insights than we will summarize here. We chose to focus on three deep cuts that stood out to us as the most crucial and relevant for decision makers in the manufacturing industry.

But don’t fret, there’s a lot more to unpack in the full report, available for download. Or to hear us unpack these three deep cuts you can watch the webinar. And if you’re still hungry for more, we’ve made the survey data in its entirety publicly available so you can explore to your heart’s content.

And now, without further ado...

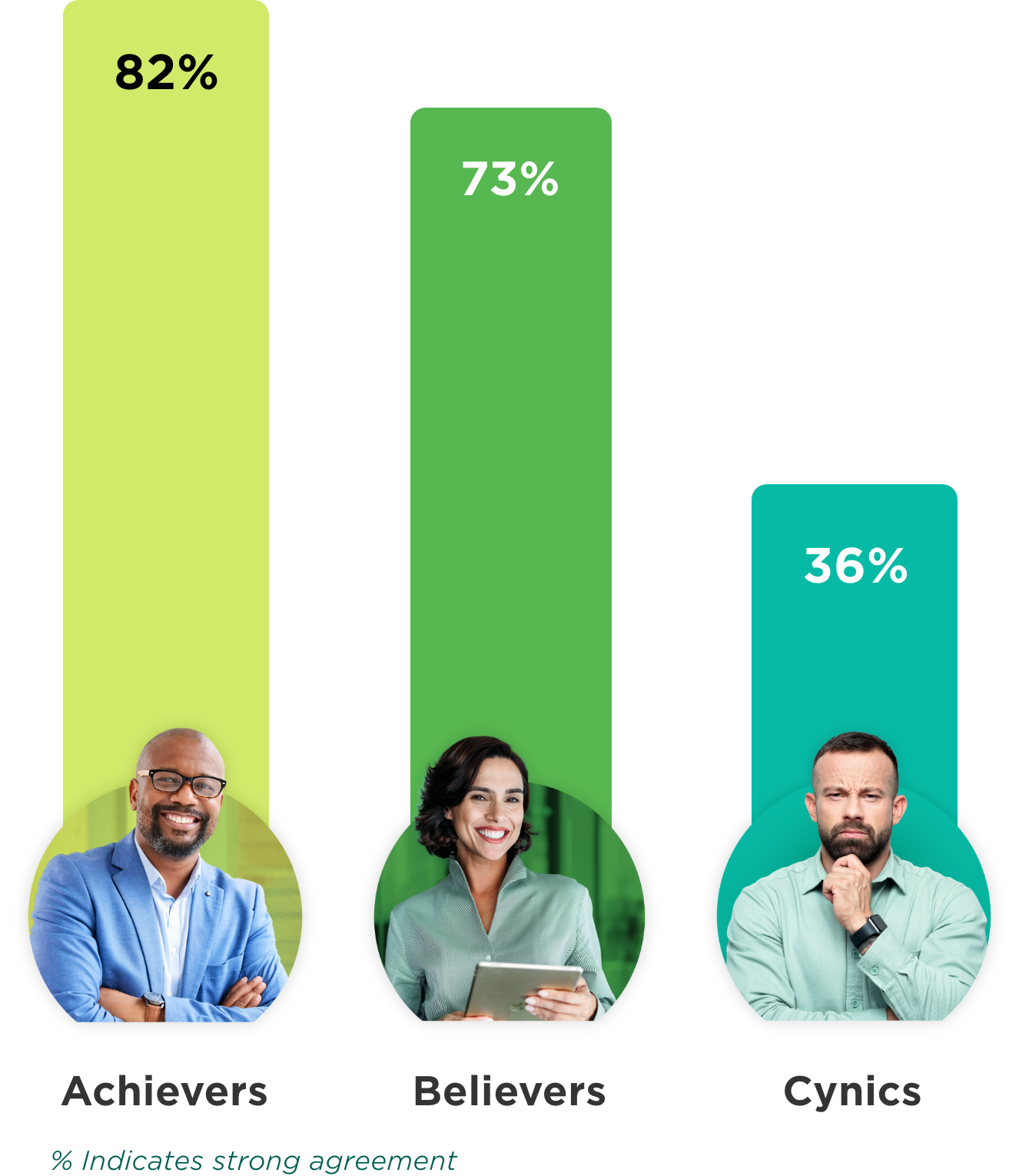

Understanding who our prospects are on a deeper level is essential to my organization’s marketing efforts:

When it comes to recognizing the importance of understanding the customer, the gap between Cynics and the other survey groups may be the most telling of any in our survey, and—to our mind—the best explanation for why Cynics are seeing such different outcomes from their marketing efforts.

The decision-makers we surveyed have clearly had enough of working with generalist agencies, the question is: what are they going to do about it? Achievers have both the highest appreciation for understanding their prospects, as well as the highest expectations of any agency they work with (for more on that, read the full report), which points towards an inevitable focus on agencies with industry expertise. On the other end of the spectrum, Cynics seem to have lowered their expectations and adopted an apathetic view of an agency's ability to understand them.

Even Cynics who didn't rate the importance of acquiring a deep understanding of their prospects very highly still had plenty to say about what agencies needed to know about them. What we're taking away from that apparent contradiction is that Cynics may not have a clear understanding of how to get that deeper understanding, and thus over-estimate its difficulty, leading to apathy around the whole concept.

This is an area where outside support can be an unexpected win for your organization. A good agency not only knows how to learn about their clients’ customers, they’ve also done it enough times to have developed an efficient process. As a result, Cynics might discover that learning about their customers is not only possible, but far more attainable than they’d assumed.

The relationship between sales and marketing is frictionless. These departments share tech and work together towards goals.

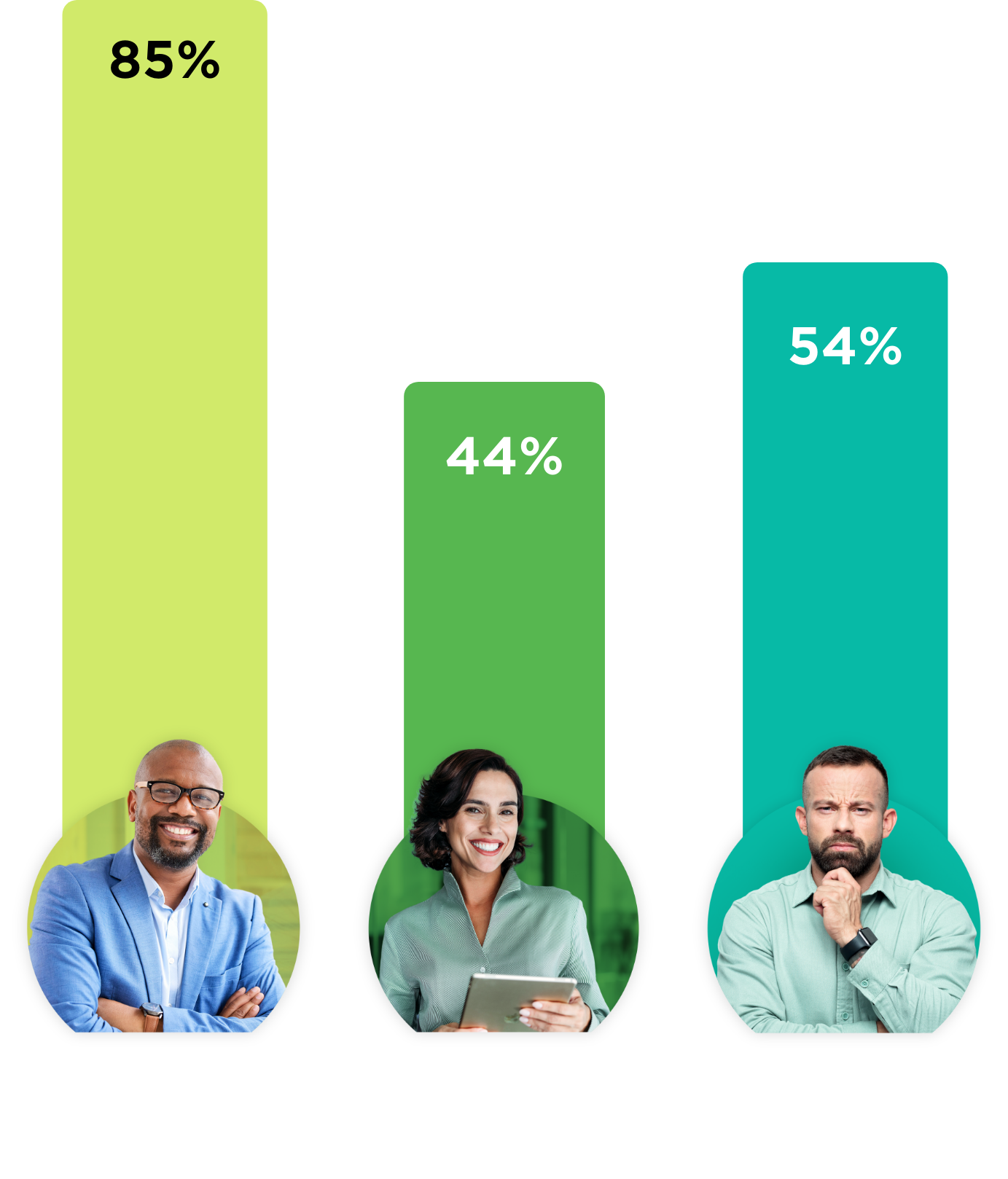

Unsurprisingly, Achievers are better at aligning their sales and marketing departments and are significantly more likely (85% strongly agree) to say this relationship is frictionless at their organizations. Believers and Cynics trail far behind at 44% and 54% respectively. It is notable that Believers fare worse than Cynics in achieving this collaboration.

The relationship between sales and marketing is...

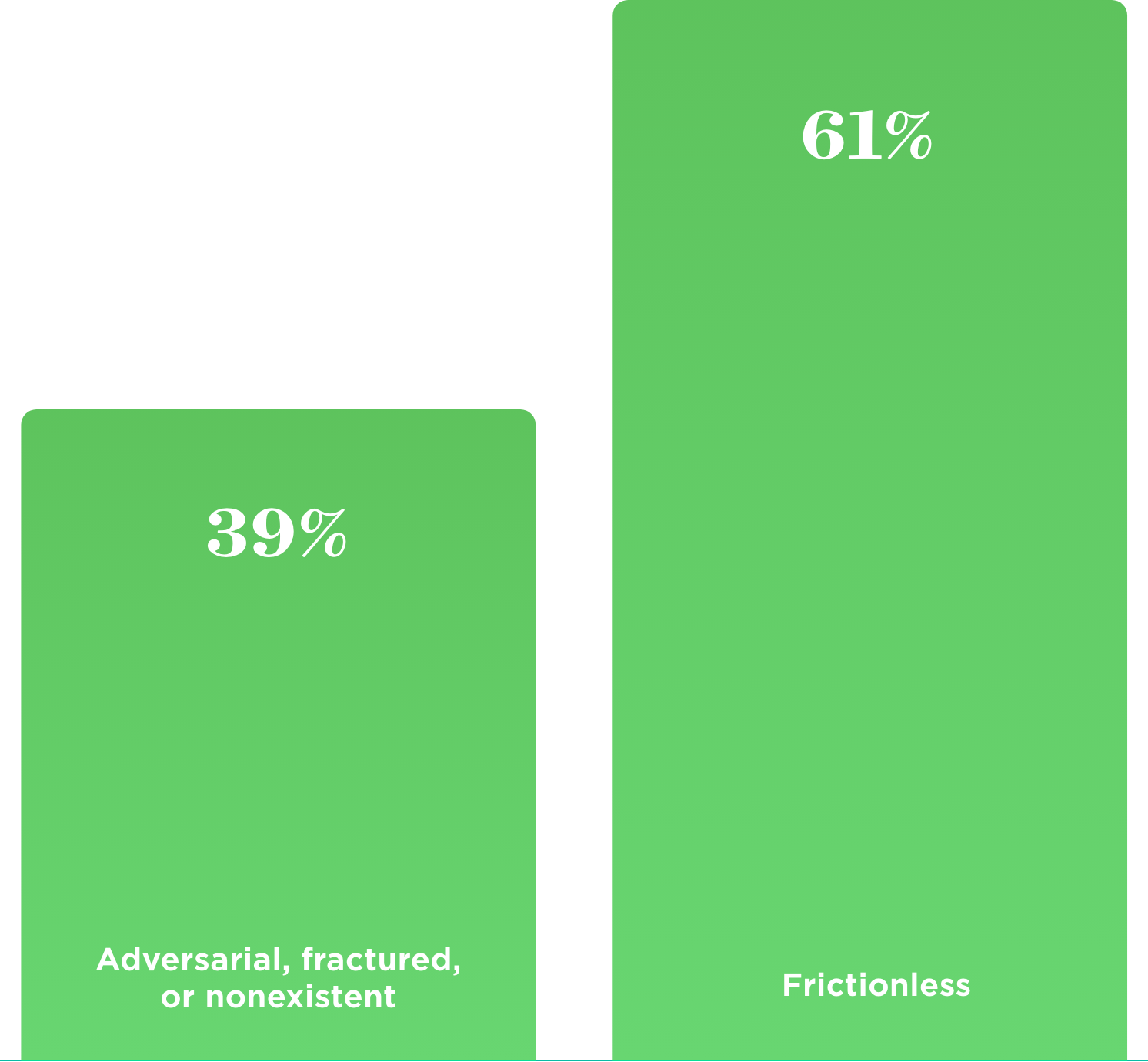

That leaves roughly four out of every ten marketers with some level of discord between these two crucial departments—either fractured communication, open hostility, or simple apathy.

All too often, when business slows, the blame game between marketing and sales begins. Sales is upset because they don't have the resources they want, the lead quality is poor, or there simply aren't enough leads. Marketing, meanwhile, feels their hands are tied because sales is withholding customer information, isn't using the new resources they've been given, or isn't reporting back key metrics.

The antidote is intentional, open communication and collaboration. When sales shares their customer insights and metrics with marketing, the marketing department can create better sales materials that reduce sales lead times by bringing in more qualified leads. It's a win/win, and that should always be the focus.

Does your organization track ROI with your marketing metrics?

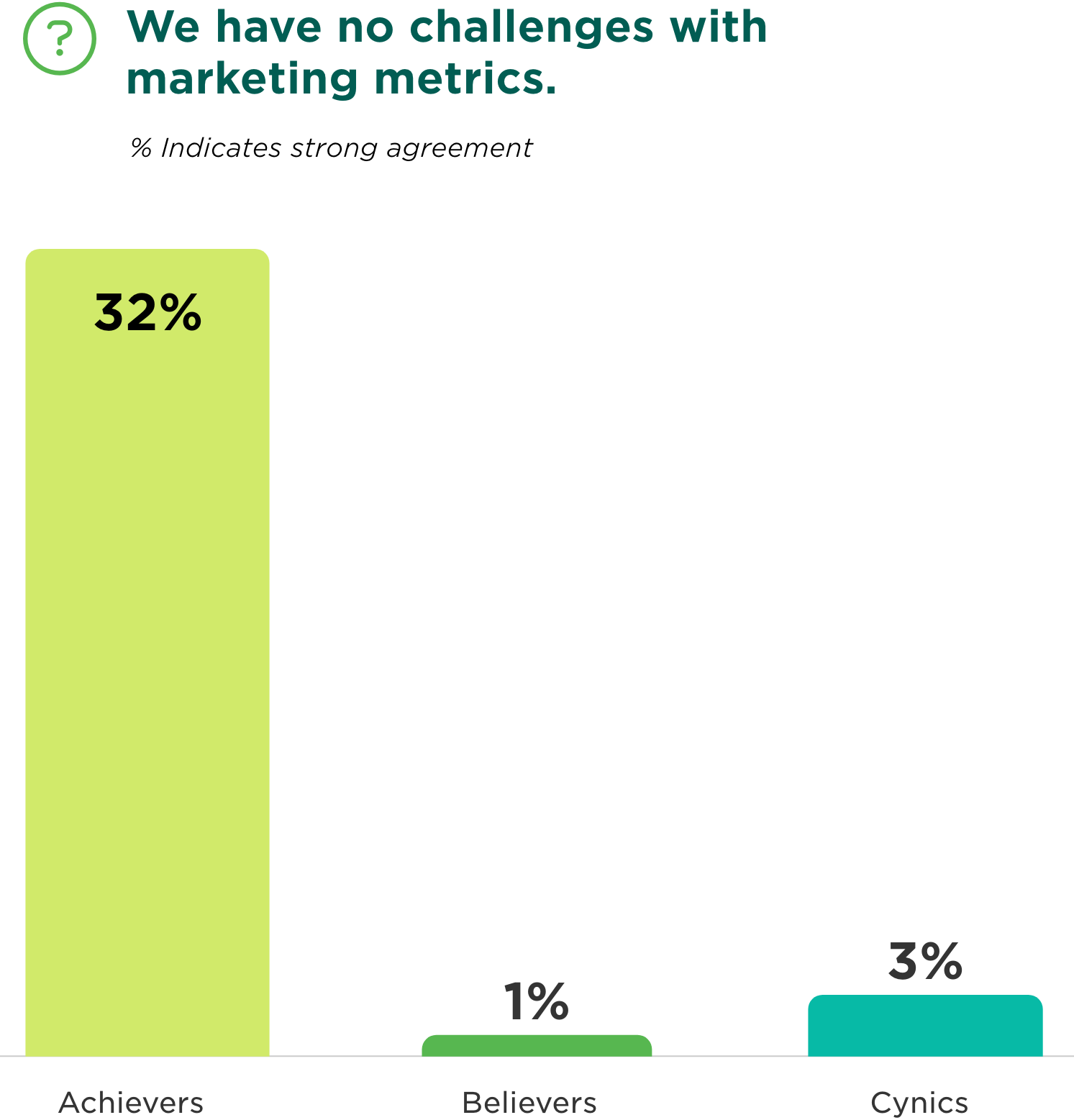

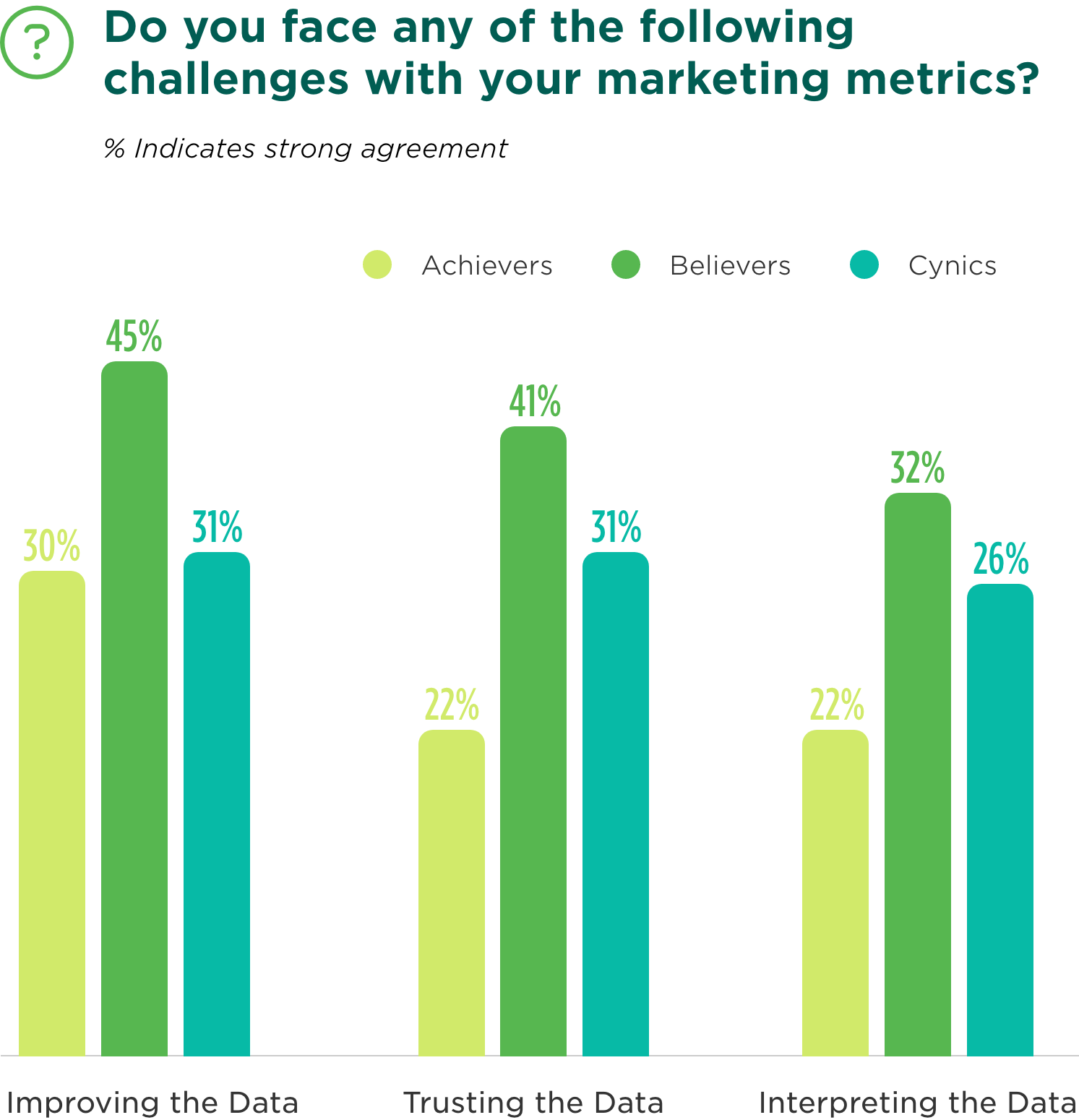

A lack of interest or ability to track key marketing metrics may be part of what keeps them in the cycle of cynicism! Anyone who has ever worked with metrics knows that sometimes they seem to operate with a will of their own, and it's easy to become disillusioned with our ability to collect and interpret them. And that's if you're even tracking the correct metrics to start with! Achievers have found not only the right metrics to track for their organization, but how to interpret them and make the right marketing moves accordingly.

Tracking marketing ROI in the B2B space is a different beast than consumer e-commerce. Sales cycles are longer and more consultative, and leads have many more touch-points before making a decision. This can drive many organizations to void tracking defined marketing metrics against business outcomes like revenut because they're afraid the numbers won't show positive ROI.

We understand this concern, and the truth is that metrics frequently fail organizations because they underestimate the effort it takes to gather meaningful data and interpret it. Don't settle for the default numbers your tech stack spits out—figure out what numbers truly matter for your business and stick with them.

Mindsets don’t change overnight. No amount of believing will shift the trajectory of your organization without specific actions to back it. Expecting to see results with minimal effort will inevitably lead to disillusionment.

The story is a work in progress. While hard knocks and unfortunate setbacks may have jaded some decision-makers, their path is not set in stone. Leaders who have made a dedicated investment in their marketing also see organization-wide transformation.

Achievers succeed because they have the cultural buy-in that breaks down barriers, and facilitates collaboration. That’s why our insights focus so heavily on actions that lay a long-term foundation for success: strengthening the handshake between Marketing and Sales, gaining clarity around metrics, and giving the appropriate time and attention to your clients and agencies.

To break the Believer–Cynic cycle, businesses must reject quick fixes or the mindset that a siloed team left to fend for themselves without resources, backing from leadership, or input from sales will be able to show meaningful improvement by next quarter.

Including:

We are a digital agency offering holistic solutions that integrate custom web functionality with multichannel marketing strategies. We take an idea from a sketch on paper all the way through getting it online and in front of people. We help our clients create comprehensive online marketing plans from inception to completion.

Audience Audit is a research firm specializing in attitudinal segmentation audience research and strategy. Founded in 2009, the firm has conducted audience research for organizations including Gap, AT&T, Jayco, and many more.